The Role of Auto Insurance in Protecting Your Financial Future

The Role of Auto Insurance in Protecting Your Financial Future

Blog Article

Unlocking Savings: Your Ultimate Guide to Economical Vehicle Insurance Policy

Browsing the landscape of automobile insurance policy can typically really feel overwhelming, yet recognizing the vital parts can unlock substantial financial savings. Variables such as your driving history, lorry kind, and insurance coverage selections play an essential function in establishing your premium expenses. By tactically approaching these components and comparing different carriers, one can discover considerable discount rates. The procedure does not end with just selecting a policy; rather, it demands ongoing evaluation and educated decision-making to make sure optimal protection and price. What actions can you require to maximize your financial savings while preserving the essential protection?

Comprehending Auto Insurance Coverage Essentials

Understanding the basics of automobile insurance coverage is critical for any type of lorry owner. Automobile insurance policy works as a safety measure against financial loss resulting from accidents, burglary, or damages to your automobile. It is not just a legal demand in most jurisdictions yet likewise a reasonable financial investment to protect your assets and wellness.

At its core, vehicle insurance generally consists of several key parts, consisting of liability coverage, accident protection, and detailed insurance coverage. Obligation coverage protects you against cases occurring from damages or injuries you trigger to others in an accident. Crash coverage, on the various other hand, covers problems to your automobile arising from a crash with one more lorry or object, while detailed insurance coverage safeguards versus non-collision-related incidents, such as theft or all-natural disasters.

Additionally, understanding plan restrictions and deductibles is essential. Plan limits determine the maximum amount your insurance firm will certainly pay in the event of a case, while deductibles are the amount you will pay out-of-pocket prior to your insurance coverage starts. Acquainting yourself with these concepts can encourage you to make educated choices, guaranteeing you select the right insurance coverage to meet your demands while keeping affordability.

Factors Affecting Premium Prices

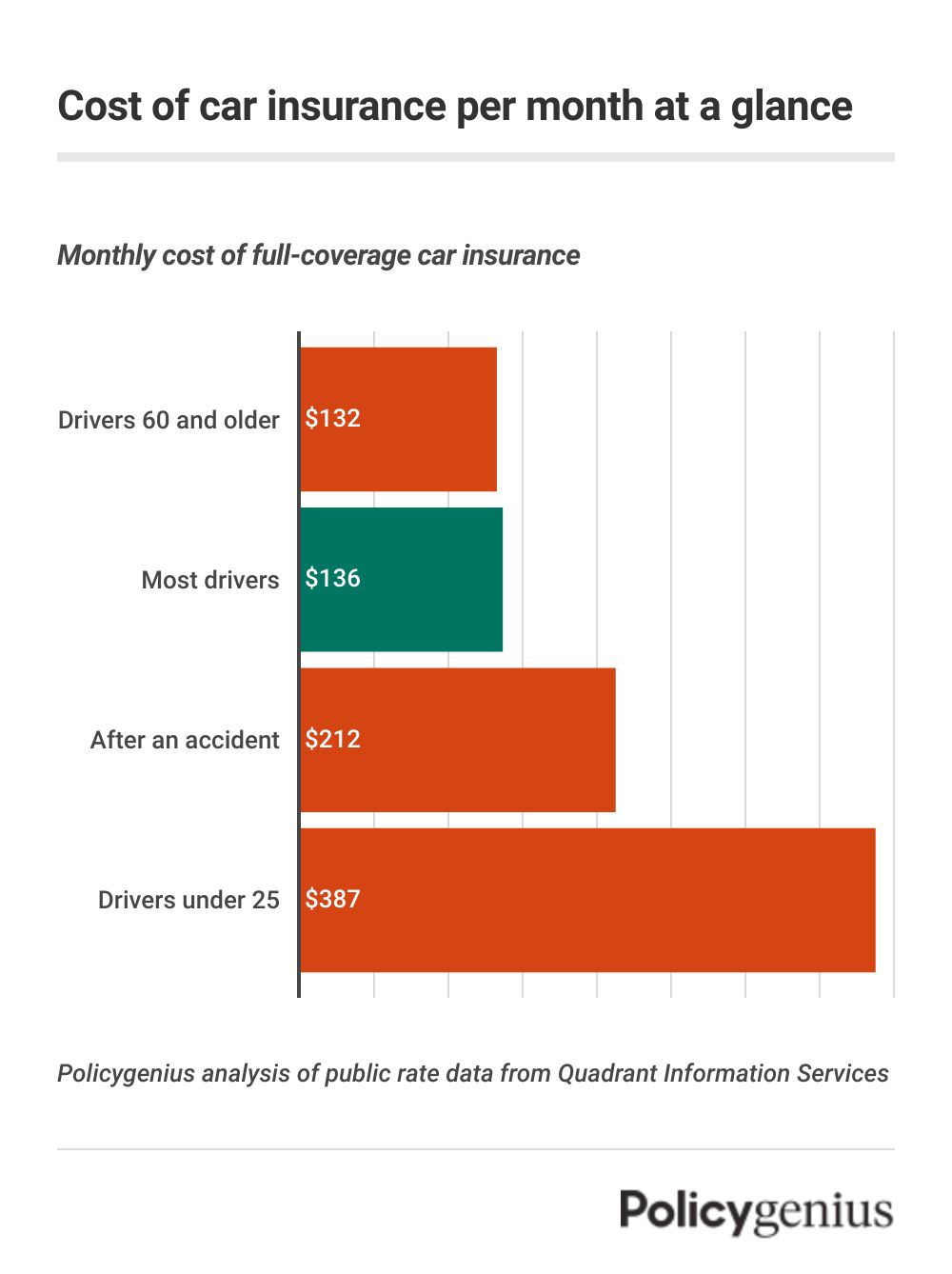

Numerous variables substantially influence the price of vehicle insurance costs, impacting the overall price of protection. Among the primary components is the driver's age and driving experience, as younger, less experienced motorists normally face higher premiums as a result of their raised danger account. Furthermore, the kind of lorry insured plays a critical duty; high-performance or luxury autos typically sustain greater prices due to their repair service and substitute expenditures.

Geographical area is an additional essential variable, with city locations usually experiencing higher costs compared to rural areas, mostly due to enhanced traffic and mishap rates. The motorist's credit rating history and claims background can additionally impact premiums; those with an inadequate credit history rating or a background of frequent insurance claims might be charged greater prices.

Moreover, the level of protection selected, consisting of deductibles and policy limitations, can affect premium prices dramatically. Lastly, the function of the automobile, whether for individual usage, travelling, or business, might additionally dictate premium variations. Understanding these elements can help consumers make get redirected here informed decisions when seeking economical vehicle insurance coverage.

Tips for Lowering Premiums

Lowering automobile insurance premiums is obtainable through a selection of strategic methods. One reliable approach is to raise your deductible. By selecting a greater insurance deductible, you can decrease your costs, though it's vital to ensure you can conveniently cover this quantity in the event of a claim.

Using available discounts can further reduce costs. Lots of insurers supply discounts for secure driving, packing plans, or having specific safety and security attributes in your car. It's smart to ask about these options.

One more method is to assess your credit history, as lots of insurer element this into costs computations. Improving your credit rating can bring about better prices.

Lastly, take into consideration signing up in a motorist security program. Finishing such programs frequently certifies you for premium discount rates, showcasing your commitment to risk-free driving. By implementing these methods, you can effectively lower your automobile insurance premiums while preserving ample coverage.

Comparing Insurance Policy Carriers

When looking for to Continue lower auto insurance policy prices, comparing insurance policy service providers is an essential action in discovering the most effective insurance coverage at a cost effective rate. Each insurance firm provides distinctive policies, coverage options, and rates structures, which can dramatically influence your overall costs.

To begin, collect quotes from numerous suppliers, guaranteeing you keep consistent coverage degrees for an accurate comparison. Look beyond the premium expenses; inspect the specifics of each plan, including deductibles, responsibility limits, and any extra functions such as roadside help or rental automobile protection. Understanding these aspects will help you determine the value of each plan.

Furthermore, consider the credibility and client service of each provider. Research study online testimonials and rankings to determine consumer satisfaction and claims-handling efficiency. A service provider with a solid record in solution may be worth a slightly greater premium.

When to Reassess Your Policy

Routinely reassessing your auto insurance coverage policy is vital for making more helpful hints sure that you are getting the best insurance coverage for your demands and budget plan - auto insurance. Additionally, obtaining a new lorry or offering one can modify your coverage demands.

Modifications in your driving behaviors, such as a new task with a longer commute, should also motivate a review. Considerable life occasions, consisting of marital relationship or the birth of a child, may demand additional protection or adjustments to existing plans.

Final Thought

Attaining financial savings on vehicle insurance requires a comprehensive understanding of protection requirements and premium influencing elements. Remaining notified and positive in reviewing options inevitably makes certain accessibility to cost effective automobile insurance coverage while preserving enough protection for assets.

At its core, car insurance policy typically is composed of numerous vital parts, including obligation coverage, accident protection, and thorough insurance coverage.Several elements considerably affect the price of car insurance costs, impacting the total affordability of insurance coverage. By applying these approaches, you can properly lower your vehicle insurance coverage costs while keeping ample coverage.

Frequently reassessing your automobile insurance coverage plan is vital for guaranteeing that you are obtaining the finest coverage for your demands and spending plan.Attaining savings on vehicle insurance policy demands an extensive understanding of insurance coverage requirements and costs influencing variables.

Report this page